Tariff slashes the sales of Chinese textiles in the U.S.

By Zhao Xinhua

With the increasingly fierce global competition, the U.S. has issued a series of policies and regulations to support the development of the textile and garment industry in terms of trade, taxation and supervision, and the textile and garment industry has also actively carried out structural adjustment. The United States transfers high—cost, low—profit products or industrial chains abroad, while leaving capital—technology—intensive, high—value—added products and industrial chains at home. It has a strong competitive advantage in high—end special yarns, high—grade fabrics, indus—trial textiles and high value—added independent brand clothing industry. Thanks to productivity, flexibility and innovation, the U.S. textile industry remains the global market leader.

In the past two years, the pandemic prevention and control measures in the United States have been on and off as the pandemic changes, and major textile and apparel retail markets have also experienced ups and downs. The U.S. apparel retail market has recov—ered slowly, but unevenly, after various government measures and rounds of economic stimulus.

US import and export trade in the postpandemic era

Total retail sales in the U.S. in 2020 are already about the same as in 2019. However, the sales of clothing products are still mired in a difficult situation, which has been in a negative growth trend, and the annual sales decreased 26.4 percent year—on—year. In 2021, with the influence of the relaxation of pandemic prevention and control, the stimulus of fiscal subsidies and the rebound of consumer confidence, consumers’ pent—up demand for clothing products exceeded USD 303.1 billion, with a year—on—year growth of 48.8 per—cent and a 12.9 percent increase compared with 2019. Textile and clothing consumption basically entered the normal development track.

U.S. textile and apparel imports declined in 2020, but rebounded sharply in 2021, driven by domestic de—mand. U.S. textile and apparel production and exports also rebounded during the period. In the global textile trade, the United States has always been a major tex—tile consumer in the world, and has become the export market for developing countries with labor—intensive textile and garment industry as the leading industry.

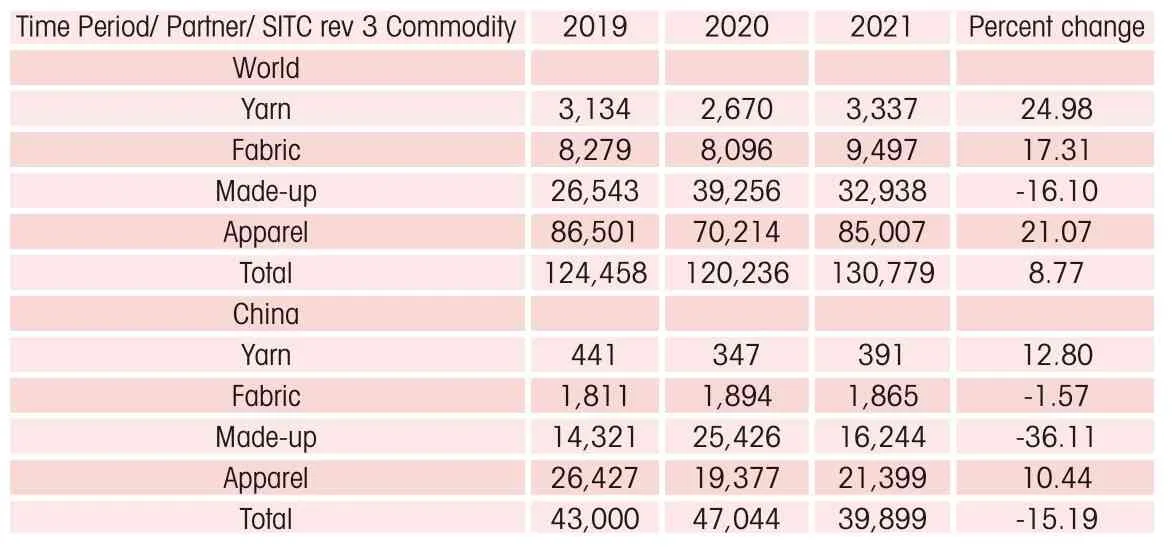

In 2021, U.S. imported USD 130.779 billion of textile and apparel from the world, with a year—on—year increase of 8.77 percent, of which, U.S. imported USD 39.899 billion of textile and apparel from China, with a year—on—year decrease of 15.19 percent, as shown in Table 1.

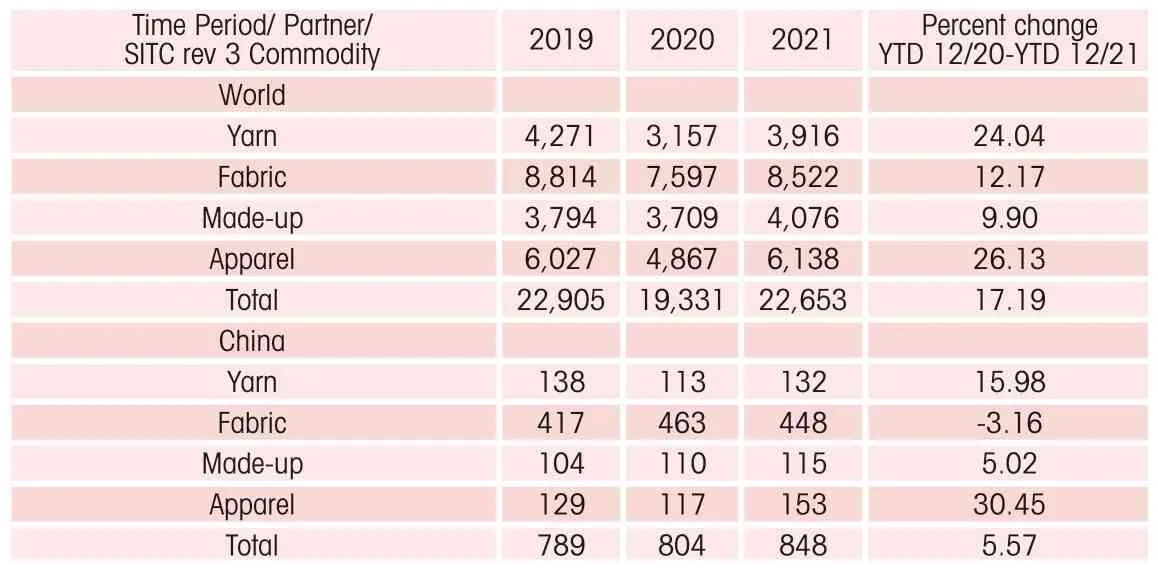

In 2021, U.S. exported USD 22.653 billion of textiles and apparel to the world, with a year—on—year increase of 17.19 percent, of which, U.S. exported USD 848 million of textiles and apparel to China, with a year—on—year increase of 5.57 percent, as shown in Table 2.

Table 1 U.S. Imports of Textiles and Apparel from World and China in 2019-2021 Flow: General imports Type: Customs value (Millions of Dollars)

Table 2 U.S. Exports of Textiles and Apparel to World and China in 2019-2021 Flow: General exports Type: F.A.S. value (Millions of Dollars)

In 2021, the pandemic has brought changes to the textile and apparel industry: the origin is closer to the market; more flexible supply; smaller, cheaper and more durable products; the correlation with the season is lower; pay more attention to sustainability, etc. A McKinsey & Co. survey of 38 chief procurement officers at clothing companies showed 71 percent said they plan to increase their nearshoring share, including 13 percent who expect to do so by more than 10 percent, while 24 percent plan to increase reshoring in their sourcing strategy.

For U.S. companies, Central America ranks highest on the list for future nearshoring activities, with about 80 percent of North American apparel firms planning to increase their company’s sourcing value share in the region.

Higher tariff decreases China's market share

Recently, there has been a renewed call in the U.S. for the reduc—tion of additional tariffs on Chinese goods. Industry insiders believe that in the context of high inflation, maintaining additional tariffs on Chinese goods will push up prices, which is not conducive to the U.S.economic recovery. If the tariff reduction is imposed on Chinese goods, it will undoubtedly be beneficial to foreign trade, which will still be an important means for the prosperity of the textile industry.

The United States is also a major producer of cotton in the world. In 2021, its cotton output was 18.3 million bales. In 2022, due to the abnormal drought in the main domestic cotton producing area and the tight international cotton supply af—fected by the Russia—Ukraine conflict, the cotton price in the United States hit a 10—year high. U.S. President Joe Biden signed an executive order ban—ning U.S. energy imports from Russia. Changes in the situation between Russia and Ukraine may further affect the price of bulk commodities in the future, and the cost of clothing will also rise sharply, which will undoubtedly bring pressure to the global tex—tile industry.

Currently, U.S. highly automated textile industry came back, In addition to the investment in expanding capacity and opening new factories announced in the U.S., most of the new investment has come from other countries outside the United States, includ—ing China, India, Mexico, Canada, Turkey and Saudi Arabia, etc. The United States textile and garment manufacturing show signs of recovery gradually.